Ethereum Reaches 60M Gas Limit: What it Means for Fusaka - Twitter in Shambles

Ethereum's Gas Limit Just Jumped: Is It Enough to Matter?

Ethereum just cranked up its block gas limit—from 45 million to 60 million. That's a 33% increase, and the headlines are screaming about scalability. But before we pop the champagne, let's dive into what this *actually* means. Ethereum Reaches 60M Gas Limit Before Fusaka Upgrade

The timing is interesting. This boost comes right before the Fusaka upgrade, slated for December 3rd. Fusaka's supposed to bring PeerDAS, a new data availability sampling method that Vitalik Buterin himself has called "key to Ethereum scaling." The narrative? More gas, better data, happier users.

Ethereum Scaling: Peak Claims vs. Real-World Performance

Digging Into the Data: TPS vs. Reality We’re seeing claims of Ethereum scaling networks hitting a record 31,000 transactions per second (TPS). Lighter, a zero-knowledge rollup, is supposedly leading the charge with 5,455 TPS, with Base tagging along at a measly 137 TPS. Sounds impressive, right? Here's where the skepticism kicks in. Those numbers are *theoretical* peaks. What's the sustained TPS? What's the cost per transaction at that peak? These are the questions no one seems to be asking. It's like advertising a car's top speed without mentioning the fuel consumption at that speed. Useless. Zhixiong Pan, an independent blockchain researcher, credits the gas limit increase to EIP-7623 (protocol-level block-size safeguards), client optimizations, and testnet results. Okay, fair enough. But testnets are sandboxes. They don't reflect the chaos of real-world network conditions. The real test will be how this new gas limit holds up under sustained load *after* Fusaka. Will we see a tangible decrease in transaction fees? Will dApp performance actually improve? Or is this just another incremental change dressed up as a revolution? And this is the part of the report that I find genuinely puzzling: Vitalik Buterin suggests future adjustments might pair gas limit increases with *higher* gas costs for computationally expensive operations. So, the network gets "bigger," but doing complex things gets *more* expensive? That's like building a bigger highway but charging a toll for every mile. It might ease congestion, but it doesn't exactly make things cheaper.Fusaka: A Patch, Not a Panacea?

The Fusaka Factor: Hype vs. Hope The Fusaka upgrade itself is being touted as a game-changer. PeerDAS, the core of the upgrade, is supposed to improve data availability for rollups. Rollups, of course, are Ethereum's primary scaling solution. The idea is that by making data more readily available, rollups can process transactions more efficiently. But here's the catch: PeerDAS is a redesign of data availability *sampling*. It's not a complete overhaul of the data availability layer. It's more like optimizing the existing system. Will it make a difference? Probably. Will it solve Ethereum's scaling woes overnight? Absolutely not. The timing of the gas limit increase and Fusaka is clearly strategic. It's designed to create a narrative of progress. The problem is, narratives don't always match reality. We need to see concrete data on transaction fees, network congestion, and dApp performance *after* Fusaka before we can declare victory. Until then, it's just noise. The Bottom Line: Show Me the DataRelated Articles

7 Best Crypto Wallets (Dec 2025): What 'Best' Really Means - Discussion Gets Real

``` Crypto "Best Of" Lists: Hype or Helpful? Crypto Wallets, Coins, and Cons: A Data Dive The crypt...

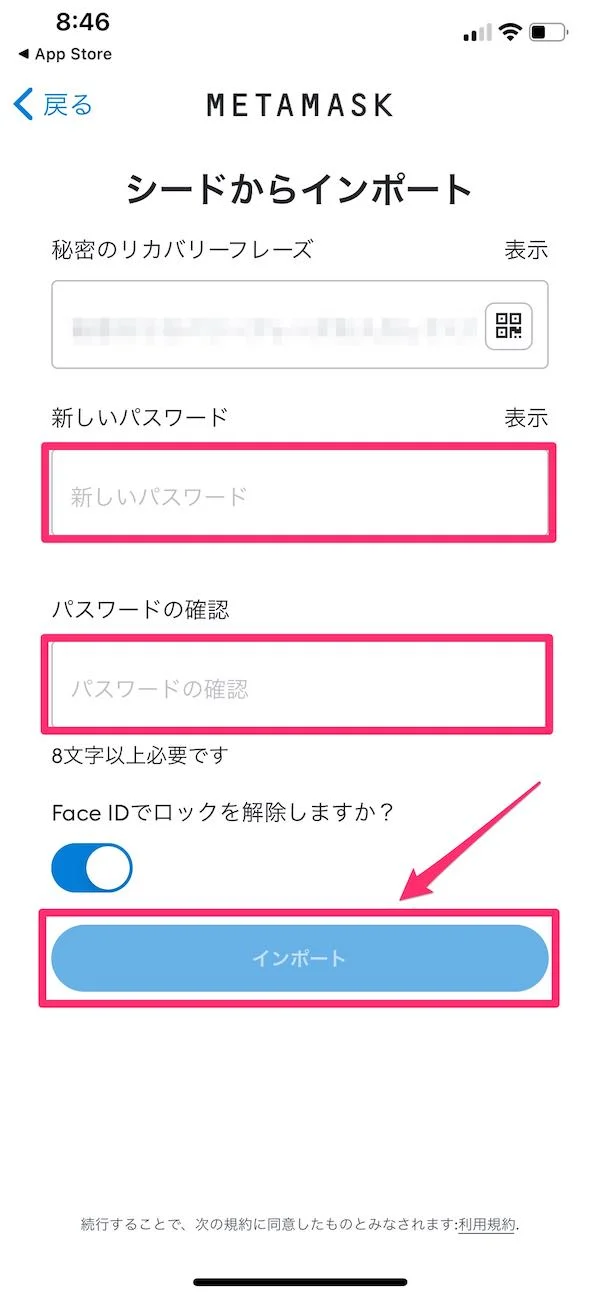

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

The Aster DEX Breakthrough: What It Is and Why It’s a Glimpse Into DeFi’s Future

A number gets thrown around in technology that is so large it almost loses its meaning: a trillion....

B&M Recalls Harvest Mug: Why Your 'Cozy' Fall Mug Might Just Explode

So let me get this straight. The primary, singular, unassailable function of a mug is to hold hot li...

Satoshi Nakamoto: The Founder's Identity vs. The Brand's Latest Play

Julian Vance here, cutting through the noise as usual. There's a new sneaker drop on the horizon tha...

NEAR Protocol's Price Prediction: Will it Rally, or is This Another Pump and Dump?

Alright, let's cut the crap. Another day, another crypto project claiming to be the "future," this t...