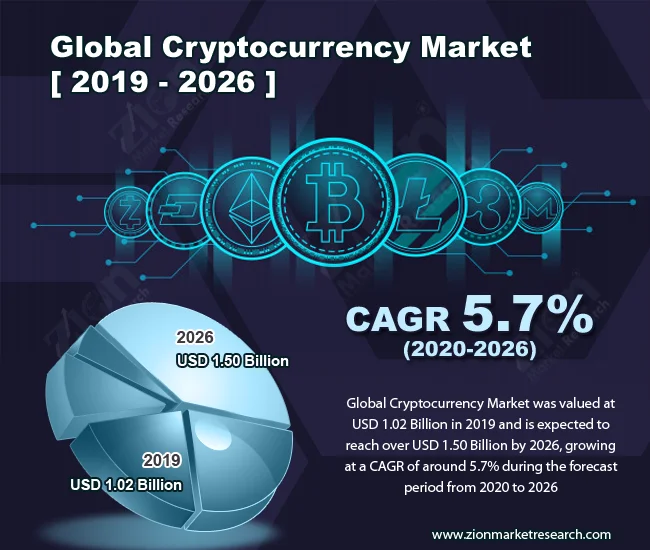

Why Crypto's Stability Is a Sham.

Crypto’s “Stabilization Phase”: Or Are We Just Being Played?

H2 The Illusion of Stability

Alright, so the "experts" are saying we're entering a "stabilization phase" in crypto. Stabilization? Give me a freakin' break. That's like saying the Titanic was entering a "controlled descent" right before it hit the iceberg.

These Bitfinex analysts are pointing to stuff like reduced debt burden and seller exhaustion. Oh, and the SOPR indicator fell below 1 for the third time in 25 months. Big whoop. Analysts love their fancy indicators. It's like reading tea leaves, except instead of predicting your future, it's predicting whether Bitcoin will go up or down 5 percent tomorrow.

And realized losses are up to $403.4 million per day. Apparently, this signals the "end of capitulation." Yeah, because losing hundreds of millions of dollars every single day is totally stable. I'd hate to see what they consider a volatile market.

They say open interest in BTC futures has decreased, showing a "gradual reduction in leverage." I'll believe it when I see it. Crypto's built on leverage. It's a casino where everyone's playing with house money—or worse, borrowed house money.

H2 Institutional Integration: The New Kool-Aid?

Oh, but wait, there's good news! BlackRock's IBIT fund increased its strategic portfolio by 14 percent! Texas is now publicly investing in Bitcoin! How touching.

Here's what that really means: The suits are moving in. The same guys who brought us the 2008 financial crisis are now "diversifying" into crypto. And offcourse, they're using our money to do it.

Experts are saying even "traditionally conservative bond funds" are using Bitcoin ETFs as diversification tools. Diversification? Or are they just trying to pump up the price so they can dump their bags on retail investors later? Let's be real, these guys aren't in it for the tech. They're in it for the quick buck, just like everyone else.

Texas investing in Bitcoin is "symbolic" and marks a "transition to direct Bitcoin custody." Symbolic of what? Another state government wasting taxpayer money on a volatile asset? Maybe I'm just too cynical, but I see this as a massive virtue signal, not some groundbreaking move toward financial freedom.

And ARK Invest bought $93 million worth of crypto companies last week despite "liquidity pressures." That sounds less like confidence and more like desperation. Like throwing good money after bad, y'know?

Then again, maybe I'm wrong. Maybe this time it's different. Maybe the institutions will save us all. Maybe pigs will fly out of my butt.

H2 The BOJ, Strategy, and Other Fairy Tales

But let's not forget the actual bad news that they're conveniently glossing over. Bitcoin took a nosedive because of rising expectations of a Bank of Japan rate hike. A rate hike is enough to send the whole market spiraling? So much for being a decentralized, inflation-proof store of value.

And Strategy CEO Phong Le is talking about potentially selling some of their Bitcoin holdings? "We can sell Bitcoin, and we would sell Bitcoin if needed to fund our dividend payments below 1x mNAV." Oh, how reassuring. So much for "hodling." The big boys will dump their bags the second things get tough.

Some analyst, Linh Tran, says Bitcoin is in a "strong correction and restructuring phase after a period of overheating." Translation: "We pumped it too hard, too fast, and now it's crashing. But don't worry, it'll probably bounce back... eventually." According to some, the Crypto Market Enters a Stabilisation Phase.

And don't even get me started on China reiterating their hard line against crypto. They expect us to believe this nonsense, and honestly... I'm starting to think a lot of these analysts are just paid shills for these crypto companies. I mean, come on.

H2 Is This Just Hopium?

Look, maybe I'm wrong. Maybe this really is a "stabilization phase." Maybe the institutions really are here to stay. Maybe Bitcoin will hit $100,000 by the end of December.

But let's be real: crypto is still a wild west. It's full of scams, hacks, and rug pulls. And these "experts" are just trying to sell you hopium so you'll keep buying their bags. Don't fall for it.

H2 We're All Gonna Get Rekt

I ain't saying to sell all your crypto. But don't believe the hype. Don't trust the analysts. And for god's sake, don't lever up. Because when this thing goes south, and it will, you're gonna get rekt.

Previous Post:Cryptocurrency Market Analysis: The Current State and Outlook (Reddit's Deep Dive)

No newer articles...

Related Articles

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...

AI's 'Rescue': The Truth About America's Tariff Mess. - Redditors React

Alright, let's get one thing straight right off the bat: Microsoft's numbers are… well, they're big....

Meta Stock Slides: Why a $16B Tax Hit and Future Spending Spooked Investors

It’s a familiar script on Wall Street, particularly in the lead-up to Big Tech earnings. Analysts li...

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...

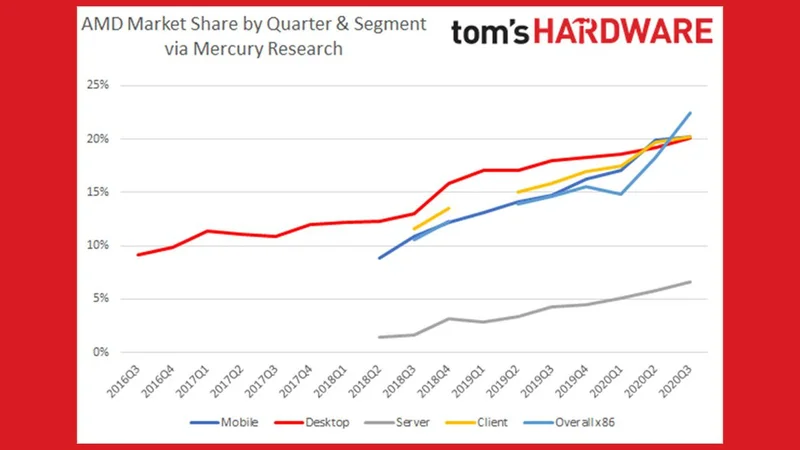

AMD's 58% Rally: Analyzing the Data vs. the Market Hype

The numbers flicker across the screen in an almost hypnotic shade of green. For anyone holding Advan...

Scott Bessent's 'Soybean Farmer' Routine: A Masterclass in Cringey, Insulting Pandering

Give me a break. I just read that Treasury Secretary Scott Bessent, a man whose net worth Forbes clo...